Keeping Subscriptions In Check Across Bundles, Family Plans, And Add Ons

Subscriptions now shape a large part of everyday spending, from streaming services and fitness apps to cloud storage, games, and productivity tools. Many of these renew automatically through app stores, card payments, or telecom bills, which means they can continue long after initial enthusiasm fades. Bundles, family plans, and small add ons can all feel reasonable on their own, yet together they may create a quiet, ongoing drain on the household budget. Treating subscriptions as a system rather than a set of isolated charges can make it easier to decide what is still worth keeping.

Background: What Subscription Hygiene Tries to Solve

Subscription hygiene is the habit of regularly reviewing and adjusting recurring digital services so that they reflect current needs. Instead of looking only at the monthly price of each item, it focuses on how different offers overlap.

Common situations include:

- Paying for a standalone music service while also having a broader bundle from Apple, Google, Amazon, or a mobile carrier that already includes similar music streaming.

- Keeping multiple video platforms active for one or two shows each, even when viewing habits have shifted.

- Paying for personal cloud storage from several providers when only one is used for everyday files.

Bundles such as Amazon Prime, Apple One, or telecom entertainment packs aim to combine services at a discount. That structure can be good value if most components are used often. If only one or two parts are used regularly, a smaller combination of individual subscriptions might be more efficient.

Family and group plans add another layer. Music, streaming, and game subscriptions often allow several people under one account at a lower combined price. When someone moves out, changes devices, or simply stops using the service, the plan may continue unchanged unless someone checks who is actually active.

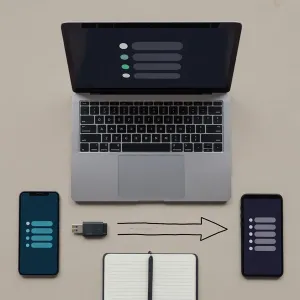

Mapping the Subscription Landscape

Before making changes, it helps to see the full picture of recurring commitments. A simple review usually draws on three main sources:

- Bank and card statements - to identify monthly and annual charges.

- App store accounts - such as Apple’s App Store or Google Play, which often hold in app and mobile subscriptions.

- Provider dashboards - for telecom, internet, and pay TV services, which may bundle entertainment, cloud, or security add ons.

Many modern banking apps and fintech tools now tag recurring payments automatically and present a list of suspected subscriptions. Services similar to Rocket Money, Mint, or open banking dashboards attempt to group charges by merchant and frequency. They may not catch everything, especially annual renewals or subscriptions billed in unusual ways, but they can highlight forgotten services or gradual price increases.

Once a list is assembled, it can be helpful to mark:

- Which subscriptions are essential (for example, connectivity, key work tools).

- Which are heavily used but optional (favorite streaming or gaming services).

- Which are rarely used or unclear (items no one in the household recognizes immediately).

This simple classification can guide later decisions.

Bundles, Family Plans, and Add Ons: Where Overlaps Hide

Overlaps often appear at three levels: bundles, family plans, and smaller add ons.

Bundles and all in one offers

Many platforms promote bundles that combine several services under a single price. Examples include:

- Delivery benefits plus video, music, and storage.

- Productivity suites that tie email, office apps, and cloud storage together.

- Mobile carrier plans that include streaming, gaming, or security add ons.

Questions that may help evaluate bundles include:

- Which parts of the bundle are used weekly or monthly?

- Are any of those components already covered by other subscriptions?

- Has the bundle changed since it was first purchased, for example through new tiers or competitor offers?

In some cases, keeping the bundle makes sense and dropping overlapping standalone services is the logical move. In other cases, switching from a bundle to a smaller combination of individual services can match actual use more closely.

Family and shared plans

Family plans can be efficient when several people use the same service. Over time, however, household changes can make these plans less aligned with reality.

Useful checks include:

- Reviewing who is currently on each family plan and whether they still use it.

- Confirming that teenagers who have moved out or roommates who have left are removed.

- Checking whether some members now have access to similar services through school or work.

Family management tools such as Apple Family Sharing, Google family groups, and platform specific profile systems can show which devices and profiles are active. While designed mainly for usage and security, they can indirectly support subscription hygiene by revealing inactive or duplicated access.

Add ons and incremental upgrades

Streaming and gaming services increasingly rely on add ons: premium picture quality, extra sports channels, ad free upgrades, additional cloud space, or extended libraries. Individually, these can feel like small improvements. Together, they can build up to a significant part of monthly spend.

A practical review might ask:

- Which add ons are genuinely noticed and valued day to day?

- Are multiple providers selling similar upgrades that serve the same purpose?

- Would reducing one or two tiers change the experience in a meaningful way?

Sometimes, stepping down from a top tier to a mid tier plan has little effect on everyday use while freeing budget for other priorities.

Using Tools and Reminders to Stay Organized

Because subscriptions renew automatically, a one time cleanup is helpful but not always enough. Building light routines can keep things in check with minimal effort.

Common approaches include:

- Quarterly or semi annual reviews of all subscriptions, focused on usage and overlaps.

- Calendar reminders for annual renewals or trial end dates to avoid unintended rollovers.

- Labels or notes in budgeting tools to distinguish between entertainment, utilities, and work related services.

Many banking apps now allow users to set alerts for changes in recurring charges, such as when a subscription increases in price or when a new recurring merchant appears. Using these alerts can provide early signals that a service has changed its terms or that a free trial has become a paid plan.

Expert Notes: Practical Steps for Better Subscription Hygiene

Personal finance educators often frame subscription hygiene as an ongoing habit rather than a drastic one time cut. Their suggestions commonly include:

- Make a single list of all subscriptions across cards, app stores, and provider accounts.

- Mark each service as essential, nice to have, or low value based on current use, not on past enthusiasm.

- Tackle overlaps first, such as multiple music or video platforms offering similar content.

- Confirm cancellation paths for each provider, whether through an app store, website account page, or telecom portal.

- Note renewal cycles, especially for annual plans and trials that convert automatically.

Consumer advocates also emphasize understanding how easy it is to leave a service. Some platforms allow cancellation with a few clicks, while others require more steps or specific timing. Knowing the process in advance can reduce friction and make it more realistic to act on decisions made during a review.

Summary

Keeping subscriptions in check is less about cutting everything and more about ensuring that bundles, family plans, and add ons align with what people actually use. A clear overview of recurring services can reveal overlapping entertainment offers, underused cloud storage, or group plans that no longer reflect who lives in the household.

Tools in banking apps, platform dashboards, and family management features all make it easier to see and adjust ongoing commitments. By revisiting these choices periodically and making small, deliberate changes, households can keep the convenience of modern subscriptions while maintaining better control over long term costs.

Reviewed by InfoStreamHub Editorial Team - December 2025